Despite the fact that during a period of several months Signal Providers demonstrate high returns, profitable trades are always alternating with the losses. This is well illustrated in the graphs of experts’ profitability – any graph is covered with "peaks". Even adding better Signal Provider into the portfolio you may not predict accurately whether the first transaction would be profitable or unprofitable. During several days there may appear drawdowns, which afterwards will be covered by a successful transaction. These drawdowns are completely natural for Signal Providers and occur often enough, so one should take them into account and not neglect the rules of capital management.

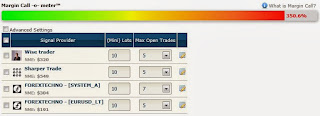

All necessary settings of the portfolio are available on the page http://zulutradeinvest.zulutrade.com/, the tab "SETTINGS". To open the advanced options of the trading experts please tick the box in the "Advanced Settings" (under the bar Margin Call-o-meter in the picture below).

Stick to the maximum of open lots depending on the size of your capital

Even the most efficient trade in the market allows some drawdowns. For a trade expert a possible size of drawdown should not exceed 10% of the profit. With strict adherence to the recommendations the temporary losses will not exceed 5-10% and the profitability graph will be quickly stabilized. For low risk one should not open more than one lot for every $ 20,000; for the average risk - no more than one lot for every $ 10,000; for high-risk - no more than 1 lot for every $ 5,000 of your capital. Remember that while your money grows you may increase the maximum number of lots, continuing to follow the rules of capital management.Add several Signal Providers to your portfolio

Due to portfolio diversification by means of several Signal Providers an efficient drawdown will decrease 2-3 times. If all Signal Providers have the percentage of successful trade more than 70, then the probability that five experts make mistakes simultaneously is less than 1%.Not every Signal Provider supports open deals 24 hours a day. Normally, experts are waiting for suitable conditions for the opening of the deal, that’s why the deals of one expert can take 5-8 hours a day. Adding several experts to your portfolio will allow using your capital more efficiently, which may significantly increase the profitability of the same amount. But it’s not recommended to add to your portfolio too many Signal Providers: the recommended quantity is 3 to 5.

In order to eliminate the dependence on high-profit experts, increase the coefficient of lots for reliable experts with low income and decrease the coefficient of lots for high-profit but risky experts (the example is given below in the table of settings for experts).

Allocate an investment profit

Allocate an investment profit not only to increase the volume of deals for already added experts, but also to expand your portfolio. When the amount is increased by a sufficient number you should add a new expert or to create a currency basket. Currency basket allows keeping investment funds in different currencies. To create a currency basket just open an additional account with your broker, and transfer a part of your funds. Then set up your new account according to the investment strategy convenient for you.Always set your stop levels to protect your capital from possible risk

By adding a Signal Provider you should set the acceptable maximum losses level: see the indicator "Stop" in the table below. If you make mistake as for the limits, it may harm your capital. To avoid it, always put limits for losses. The required limit may vary for different Signal Providers, advices on limits for individual experts can be found in the section Signal Providers review. Please make sure that all added experts have stop levels with a value not more than 100 points.The maximum number of deals multiplied by a multiplier of lots of experts should not exceed a maximum of open lots for your account

In order the strategy of Signal Providers would be completely fulfilled in your portfolio, all deals of your experts need to be performed as well. Therefore, the maximum volume of deals of trade experts shall not exceed the maximum of the open lots.Add the volume of deals for each expert, e.g. for the table below we’ll get: 0.1 * 0.1 * 5 + 5 + 7 + 0.5 * 0.5 * 5 = 7 lots. This volume of deals essentially exceeds the maximum of open lots equal 3. In this case, you should decrease the multiplier of lots for experts Signal Provider FOREXTECHNO - [EURUSD_LT] from 0.5 to 0.2 and maximum number of deals for FOREXTECHNO SYSTEM A from 7 to 5.

No comments:

Post a Comment